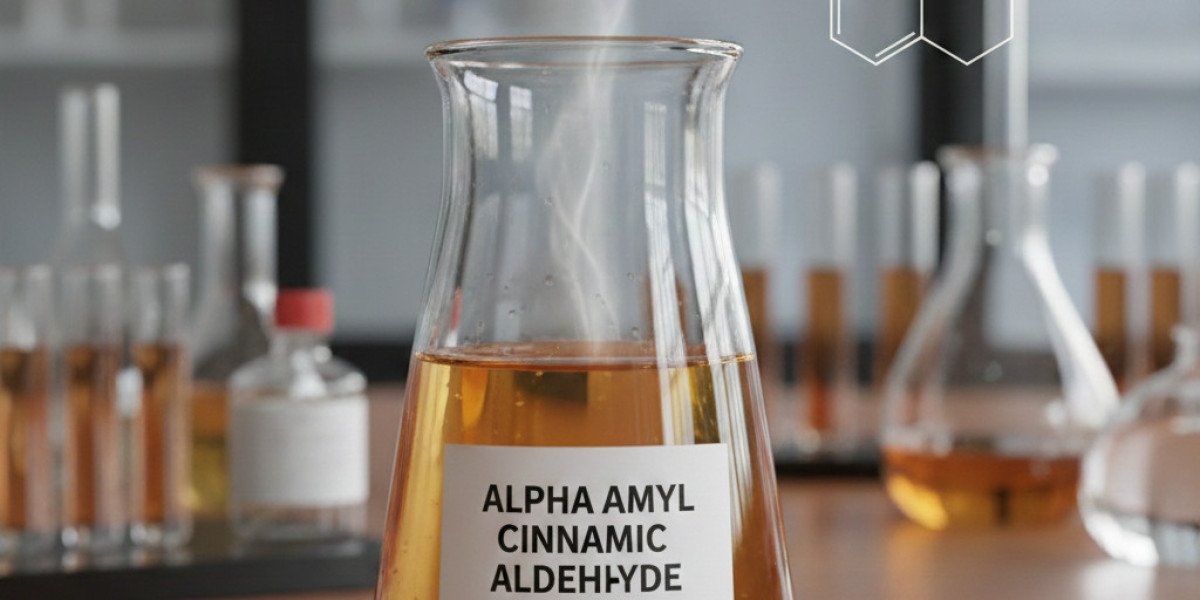

The global chemical and fragrance industry closely monitors Alpha Amyl Cinnamic Aldehyde Prices because this compound plays a vital role in perfumery, cosmetics, and household product formulations. Alpha Amyl Cinnamic Aldehyde (AACA) is an aromatic aldehyde widely valued for its warm, floral fragrance and stability in formulations. It is commonly synthesized from cinnamic acid derivatives and appears as a pale yellow liquid with strong odor intensity. Its major applications include perfumes, soaps, detergents, cosmetics, and other personal care products, making it a crucial ingredient in the fragrance supply chain.

Market Overview

Alpha Amyl Cinnamic Aldehyde belongs to the cinnamic aldehyde family and is primarily used in fragrance applications due to its jasmine-like scent. The compound’s versatility and compatibility across multiple formulations make it indispensable for personal care and consumer goods industries.

The pricing of AACA is influenced by multiple factors, including:

Feedstock availability and petrochemical cost fluctuations

Energy costs affecting production expenses

Consumer demand for perfumes and personal care products

Industrial production levels in major manufacturing economies

Global supply chain and logistics conditions

These factors collectively determine Alpha Amyl Cinnamic Aldehyde Prices across major regions such as North America, Asia-Pacific, and Europe.

Recent Price Trends: 2025 Market Performance

North America

During the quarter ending September 2025, Alpha Amyl Cinnamic Aldehyde Prices in the United States remained relatively stable. This stability reflected balanced supply-demand conditions combined with declining production costs caused by softening feedstock prices.

Key market indicators influencing pricing included:

Retail sales increased by 5% in August 2025, supporting demand for fragrance products.

Industrial production rose by 0.9%, indicating increased manufacturing activity for consumer goods containing AACA.

Natural gas prices declined, reducing energy costs associated with chemical production.

Rising global oil inventories exerted downward pressure on feedstock expenses.

However, economic factors such as declining consumer confidence and increased unemployment moderated discretionary spending, preventing significant price growth. Overall, Alpha Amyl Cinnamic Aldehyde Prices Trends in North America reflected steady but cautious market conditions.

Asia-Pacific

The Asia-Pacific region experienced mixed pricing movements. In China, the Alpha Amyl Cinnamic Aldehyde Price Index declined quarter-over-quarter due to contracting manufacturing activity and weak consumer demand.

Important market drivers included:

Declining Producer Price Index (PPI), which exerted downward pressure on chemical prices.

Reduced consumer confidence, impacting fragrance product demand.

Rising input costs, which increased production expenses during late 2025.

Overcapacity in the global chemicals industry, keeping margins tight.

Despite weak demand signals, industrial production growth of 6.5% year-on-year provided some underlying support for chemical consumption. These dynamics created fluctuating Alpha Amyl Cinnamic Aldehyde Prices Trends in the APAC region.

Track Real Time Pirce of Alpha Amyl Cinnamic Aldehyde

https://www.chemanalyst.com/ChemAnalyst/PricingForm?Product=Alpha%20Amyl%20Cinnamic%20Aldehyde

Europe

In Europe, particularly Germany, the price index also declined during Q3 2025. This decrease was driven by contracting manufacturing activity and weakened demand for chemical inputs.

Major pricing influences included:

Declining industrial production levels

Lower producer prices due to falling energy costs

Rising naphtha feedstock expenses

Reduced chemical capacity utilization across the region

Although retail sales showed slight improvement, overall market sentiment remained cautious, keeping Alpha Amyl Cinnamic Aldehyde Prices within a relatively narrow range.

Key Factors Influencing Prices

1. Feedstock Cost Fluctuations

Feedstock prices, including petrochemical derivatives and energy inputs, are among the most significant determinants of AACA production costs. Changes in oil inventories, natural gas pricing, and petrochemical supply directly impact manufacturing expenses and market pricing.

2. Energy Price Dynamics

Energy costs significantly influence the chemical industry. Lower natural gas prices reduce operational expenses, while higher energy costs increase production costs and support price stability or increases.

3. Consumer Demand for Fragrance Products

Since AACA is widely used in perfumes and cosmetics, consumer spending trends strongly affect market demand. Declining consumer confidence and lower disposable income can reduce demand for fragrance products, leading to price declines.

4. Industrial Production Levels

Manufacturing activity in key economies plays a critical role in determining demand for chemical intermediates. Higher industrial output supports price stability, while contraction leads to downward pricing pressure.

Supply Chain and Market Dynamics

Production Capacity

Global production capacity and utilization rates influence supply availability. Excess chemical industry capacity can lead to oversupply, resulting in downward pressure on Alpha Amyl Cinnamic Aldehyde Prices.

Trade and Logistics

International trade conditions, shipping costs, and logistics disruptions can affect pricing. Efficient supply chains help maintain stable pricing, while disruptions may cause short-term volatility.

Regional Market Differences

Pricing patterns vary by region due to differences in feedstock costs, energy pricing, and demand conditions. North America tends to experience more stable pricing compared to APAC and Europe, where economic conditions are more variable.

Latest Market Outlook for 2026

Looking ahead, Alpha Amyl Cinnamic Aldehyde Prices Trends in 2026 are expected to remain influenced by a combination of economic and industry-specific factors.

Short-Term Outlook

In the near term, prices are expected to remain stable due to balanced supply-demand conditions. Lower energy costs and moderate feedstock prices are likely to prevent significant price increases.

Medium-Term Outlook

By mid-2026, pricing may experience gradual growth if consumer demand for fragrances and personal care products strengthens. Industrial production recovery and improved consumer confidence could support increased chemical consumption.

Long-Term Outlook

Long-term forecasts suggest steady market growth driven by:

Rising global demand for personal care and cosmetic products

Expanding fragrance industry applications

Increased product innovation in perfumery

These factors are expected to sustain stable pricing trends beyond 2026.

Challenges and Market Risks

Several risks could impact future pricing:

Economic slowdowns reducing consumer spending

Feedstock price volatility

Energy cost fluctuations

Supply chain disruptions

Environmental regulations affecting chemical production

Addressing these challenges will be essential for maintaining stable Alpha Amyl Cinnamic Aldehyde Prices.

Conclusion

The global market for Alpha Amyl Cinnamic Aldehyde is characterized by stable yet dynamic pricing patterns influenced by feedstock costs, energy prices, consumer demand, and industrial activity. Recent market data indicates that Alpha Amyl Cinnamic Aldehyde Prices Trends in 2025 showed regional variations, with stability in North America and declining trends in Asia-Pacific and Europe due to weak demand conditions.

As the industry moves into 2026, prices are expected to remain stable in the short term, supported by balanced supply and demand fundamentals. However, long-term growth prospects remain positive due to expanding applications in fragrances, cosmetics, and consumer goods. Continuous monitoring of economic indicators and feedstock trends will be crucial for understanding future pricing behavior.